These budget hacks are great to keep your finances on track!

When it comes to handling finances, most of us have this one thing in common – we struggle to make consistent progress.

I know what you’re thinking, it’s really hard to stick within the budget especially if you have little to no money to pay for the rent, groceries, gas, debts, etc.

But there are proven ways that can help us to better manage and spend our hard-earned money. (You gotta read #10 Tip to know what one millennial did, it’s totally mind-blowing!)

So check out this list of “10 Best Budget Hacks That’ll Help Improve Your Finances.”

Some of these are easy to implement but a few really need our discipline and total commitment.

Let’s dive into it!

PIN THIS FOR LATER!

10 Best Budget Hacks That’ll Keep Your Finances on Track

This post contains affiliate links. For more information, please see my disclosures here.

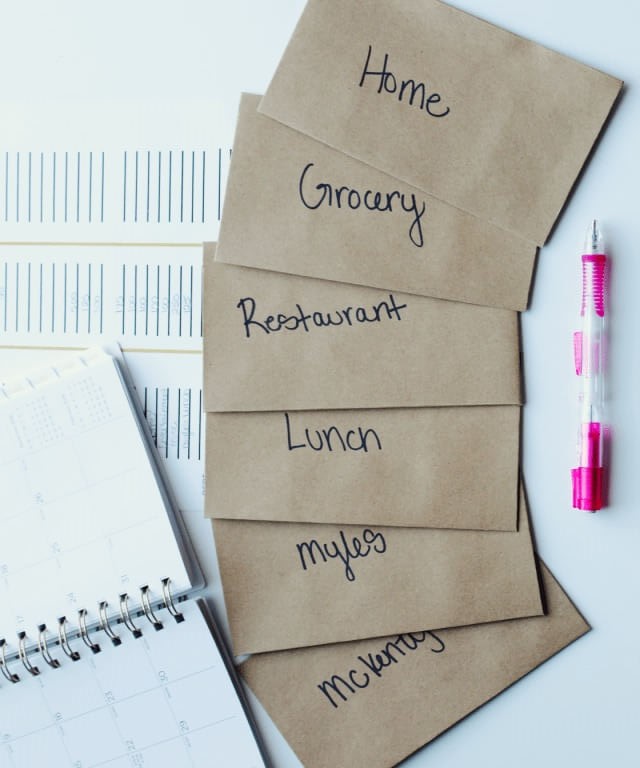

1. Use the envelope budgeting system

It might seem like an old method, but this trick surely works!

How?

Simply create envelopes and stuff them with cash after you pay your bills and put money aside for savings and investments.

For each envelope write the name of the category that needs budgeting.

Here are some common categories: groceries, clothing, household items, dining out or entertainment, gifts, gas, and allowance.

Then, put the budgeted amount of cash in each envelope after each paycheck.

The best thing about the envelope budgeting system?

It’s very tangible. You only use cold hard cash to control your spending and when you run out, you stop spending. Easy, right?

2. Go organic by growing organic (budget hacks)

We know buying organic can be really costly, right? So why not start your own organic garden instead? Gardening is easier than you might think. Check out this awesome article for all the steps and supplies you need.

So aside from growing your own delicious and fresh produce, think of how much money you could shave off your grocery bill every month!

3. Buy generic products

Unless you’re total “brand-conscious,” avoiding brand names (whether for medication or other products) is a good way to cut your expenses.

Try buying generics or other low-cost alternatives that will give you the same benefit, only at a cheaper price. That makes sense, right?

4. Ask for discounts (budget hacks)

It takes skills and confidence to ask for a better deal on an existing price. But if you’re a customer in good standing, it never hurts to request a price break.

Even small discounts matter and they could go a long way if you add them all.

So whenever you work with a gas company, phone company, internet provider, or even your credit card company, ask if there is a way to lower your costs.

5. Stop buying commercial household cleaning products.

With a long and scary list of toxins in the average bottle of household cleaner, switching to simple and pure cleansers is a lot healthier and much cheaper.

Baking soda, lemon juice, white vinegar, old coffee grounds, and simple hot water can do the same cleaning jobs for pennies.

6. Scan grocery receipts for cashback (budget hacks)

Those grocery receipts that you just throw away after shopping, scan them ASAP! It’s because some apps have a 3-day rule to scan your receipt.

If you wait too long, you’ll miss the chance of earning. Well, it will only take a minute of your time but you’ll likely earn about $5/week, which translates to hundreds a year!

So even if you think you have already stretched your grocery budget to buy groceries at the cheapest price, these apps will put more money back into your wallet with each visit.

Ibotta

Checkout 51

Grocery iQ

Coupons

Trim

7. Start walking

If you live 20 miles from your office, then you have no choice but to drive or take the bus. But if it’s just around a 15-minute walk, then do so, at least on a part-time basis.

It’s not only good for your body but for your budget as well.

Imagine saving money on gas, parking, bus fares, and taxi or rideshare costs.

8. Minimize food waste by Repurposing leftovers (budget hacks)

A study shows that the average American household throws away $640 worth of food each year.

That’s a lot of cash! Cash that could be better spent elsewhere or could be saved for your retirement. Think about it.

Repurposing leftovers is one way to help reduce food waste in your home as well as save money on your grocery bills.

For example, the leftover pot roast becomes the next night’s beef stew.

By repurposing your leftovers, you can cut back on food waste and get more creative with your meals at the same time.

9. Buy things when they are out of season

Buying things when they’re out of season is so much cheaper than buying when they’re in peak season because of low demands.

Let’s say, summer just ended so many stores are clearing out their summer collection.

That’s the best time to buy your summer dresses, shorts, t-shirts, or flip-flops now and keep them for next spring and summer.

10. Have a “zero spend” day a week (budget hacks)

It may be a challenge for most of us. But this is an easy trick one millennial did that helped him save $18,432 in 6 months.

Make a commitment to yourself to avoid buying anything- be it a morning coffee or an item from a drugstore at least one day a week.

If you want to pay off debt, retire early or finish rich, start saving now, no matter how much.

That’s it, guys! Hope these budget hacks help you rethink how you manage and spend your money.

Do you have other budget tips in mind? Share them in the comments below!

RELATED ARTICLES YOU’LL LOVE:

- Earn Money from Home Online – Make $100/Day in 2026

- Get Paid to Write: 22 Best Sites to Make $100+!

- Get Paid to Teach English Online – Earn Extra from Home

Loved this post? Take a second to PIN it and let others know. Sharing is caring.

If you find this article useful, please share it on Facebook or Pinterest. Thank you for visiting Sharp Aspirant!

Follow us on PINTEREST for more money tips!

Join Swagbucks & Get Your $10 Bonus Now!

1 thought on “10 Best Budget Hacks To Improve Your Finances”